|

|

|

|

|

|---|

|

|

|

|---|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

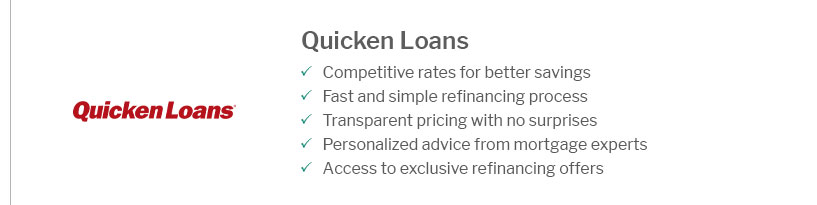

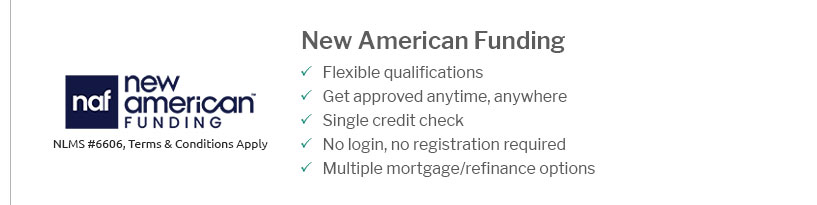

Exploring the Top 20 Mortgage Lenders: A Comprehensive ReviewIn the ever-evolving landscape of home financing, understanding the nuances of mortgage lending is crucial. This article delves into the top 20 mortgage lenders, offering a meticulous examination to aid prospective homeowners in making informed decisions. As we navigate through this list, it's essential to appreciate both the strengths and potential pitfalls associated with each lender, crafting a narrative that empowers consumers to choose wisely. First on our list is Quicken Loans, a titan in the industry renowned for its digital prowess. Their user-friendly online platform, Rocket Mortgage, is a game-changer, streamlining the application process with remarkable efficiency. However, some users have noted the absence of in-person service, which may deter those who prefer face-to-face interactions. Next, Wells Fargo, a name synonymous with banking excellence, offers a broad array of mortgage products. Their strength lies in the personalized service and extensive branch network, although they have faced challenges with regulatory compliance in the past. Then we have Bank of America, a stalwart that merges robust online tools with competitive rates. Customers appreciate their Preferred Rewards program, which provides enticing discounts. Yet, their stringent lending criteria might pose a hurdle for some borrowers. Another noteworthy lender is Chase, distinguished by its seamless integration of technology and traditional banking. Their comprehensive educational resources are commendable, though their fees can sometimes be on the higher side. US Bank stands out with its flexible loan options and commendable customer service, but potential clients should be aware of their somewhat limited geographical reach. LoanDepot is praised for its competitive rates and swift approval process, thanks to their technology-driven approach. However, transparency in fees could be enhanced for a better customer experience. Caliber Home Loans offers a personalized touch with their mortgage specialists, catering well to first-time homebuyers, although their online presence could use some bolstering. Similarly, Flagstar Bank is lauded for its extensive mortgage product lineup, albeit with a need for improvement in customer satisfaction ratings. Turning our attention to Navy Federal Credit Union, which excels in serving military personnel and their families, providing exceptional member benefits. The downside is their membership restrictions, which limit broader accessibility. SunTrust, now part of Truist, offers competitive ARM products, yet their merger transition has occasionally led to service inconsistencies. PNC Bank is another key player, offering diverse loan options and robust mobile banking services, though some borrowers report a slower-than-desired approval process. Citizens Bank impresses with its educational resources and first-time buyer programs, but the lack of a nationwide branch network might be a disadvantage for some. BB&T, also merged into Truist, presents a strong regional presence with competitive rates, though clarity in their fee structures could be improved. When considering New American Funding, their dedication to serving underserved communities is commendable, although their online interface could benefit from enhancements. Similarly, Guild Mortgage is recognized for its extensive loan options tailored to specific needs, with room for improvement in technological infrastructure. Guaranteed Rate is a frontrunner in digital innovation, offering a smooth online process, yet their physical branch availability is limited. Fairway Independent Mortgage boasts personalized service and community involvement, but transparency in loan terms could be better communicated. Fifth Third Bank provides unique loan programs and commendable customer service, though they have a smaller national footprint. Lastly, PrimeLending is noted for its tailored mortgage solutions and customer education initiatives, with an opportunity to expand its digital offerings. In summary, the mortgage lending arena is filled with diverse options, each offering distinct advantages and considerations. As a prospective homeowner, weighing these factors against personal needs and circumstances is imperative in navigating this pivotal financial decision. The key is to approach the process with diligence, armed with knowledge and a clear understanding of both the market and individual priorities. https://reverse.mortgage/best-reverse-mortgage-lenders

We've compiled a list of the top 20 reverse mortgage companies across the nation, along with five essential tips for selecting the lender that's right for you. https://finance.yahoo.com/news/top-20-biggest-mortgage-companies-193527559.html

Leading Mortgage Companies in the United States. Some of the leading mortgage companies in the United States include Rocket Companies, Inc. ( ... https://www.scotsmanguide.com/rankings/top-mortgage-lenders/2023-top-overall-lenders/

25, American Financial Network Inc. Brea, CA ; 26, Change Lending, Anaheim, CA ; 27, Bay Equity Home Loans, Corte Madera, CA ; 28, Primary Residential Mortgage ...

|

|---|